Average True Range Indicator Calculation

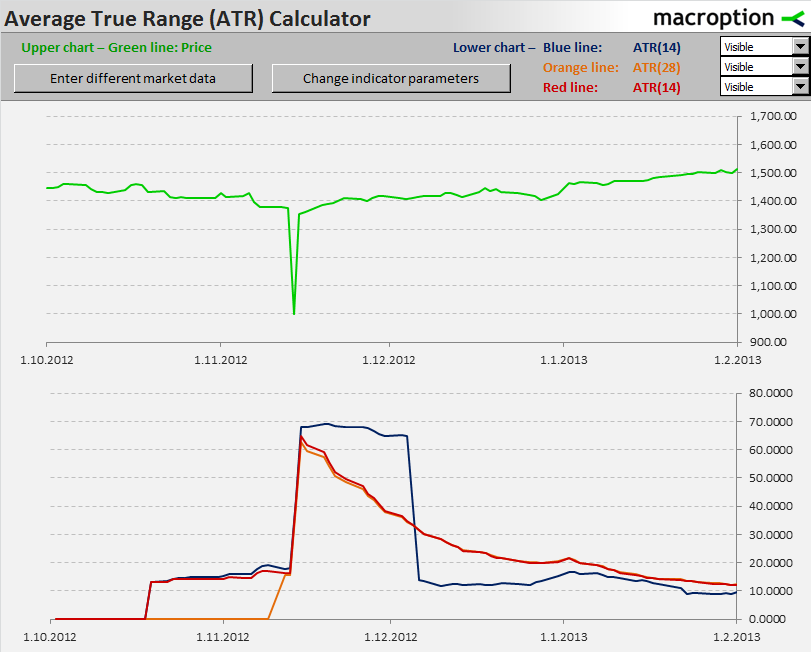

In theaverage true range indicator the ups and downs in value shown in the upper right corner in the window.

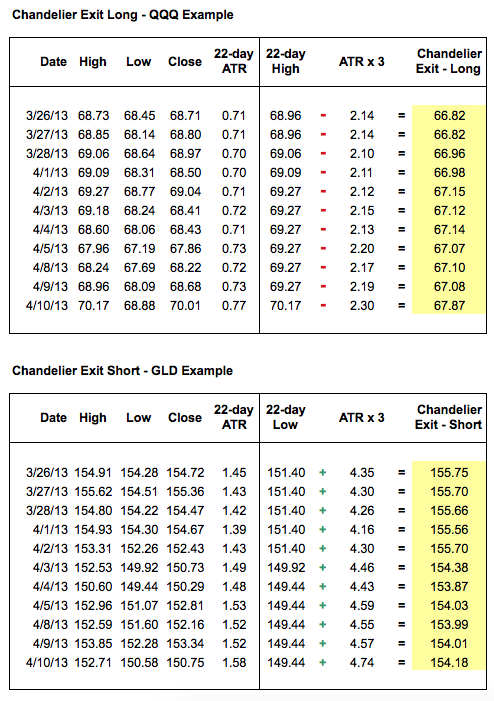

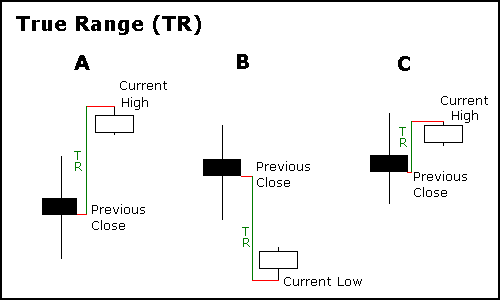

Average true range indicator calculation. The indicator does not provide an indication of price trend simply the degree of price volatility. The indicator can help day traders confirm when they might want to initiate a trade and it can be used to determine the placement of a stop loss order. Average true range atr indicator calculates the average candles ranges over a specified period. The average true range atr is an exponential moving average of the true range.

Wilder used a 14 day atr to explain the concept. In order to calculate the average true range you take the average of each true range value over a fixed period of time. Remember that the atr calculates only the historical volatility and that it can t predict the future. So the average true rangeindicator calculates the numbers and prepares planning for making a decision.

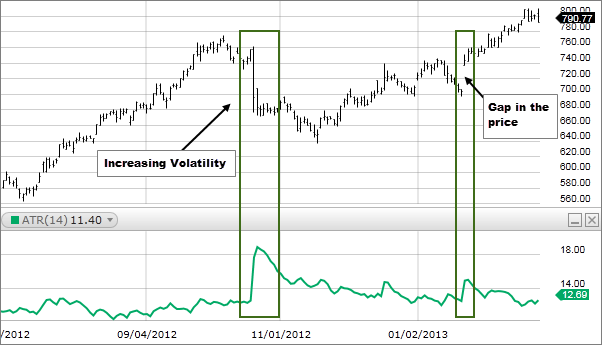

It shows the changes in chart of the past 14 days. It is typically derived from the 14 day moving average of a series of true range indicators. Traders can use shorter or longer timeframes based on their trading. The indicator says nothing about trend strength or direction.

Examining the atr indicator. Average true range atr is a volatility indicator that shows how much an asset moves on average during a given time frame. Instead it just shows the volatility level. Calculation typically the average true range atr is based on 14 periods and can be calculated on an intraday daily weekly or monthly basis.

Average true range atr is a technical analysis volatility indicator originally developed by j. We will do all the three popular atr calculation methods simple exponential and the original wilder s smoothing method. Theaverage true range is the set of 14 days. Average true range atr is a technical indicator measuring market volatility.

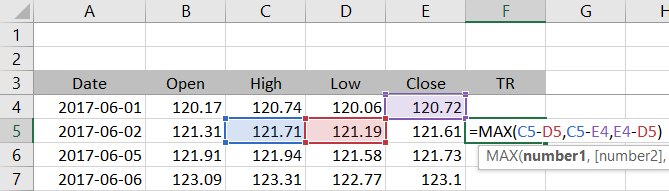

Atr to calculate the stop loss every time you are choosing your entry size you need to take into account the price volatility. We will first calculate true range and then atr as moving average of true range. For example when calculating the average true range for a 14 day period you would take the average of the true ranges over 14 days. Calculating average true range atr in excel this is a detailed guide to calculating average true range atr in excel.

For commodity market analysis. Average true range is a technical analysis indicator that measures the price change volatility.

/ATR-5c535f8fc9e77c000102b6b1.png)