Backdoor Roth Ira Conversion Rules

Backdoor roth iras are not a special type of account.

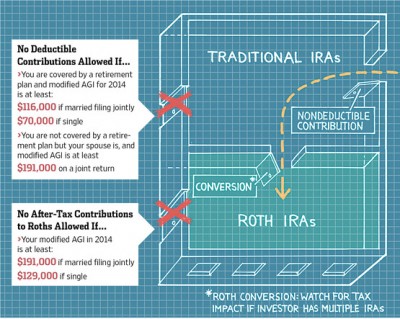

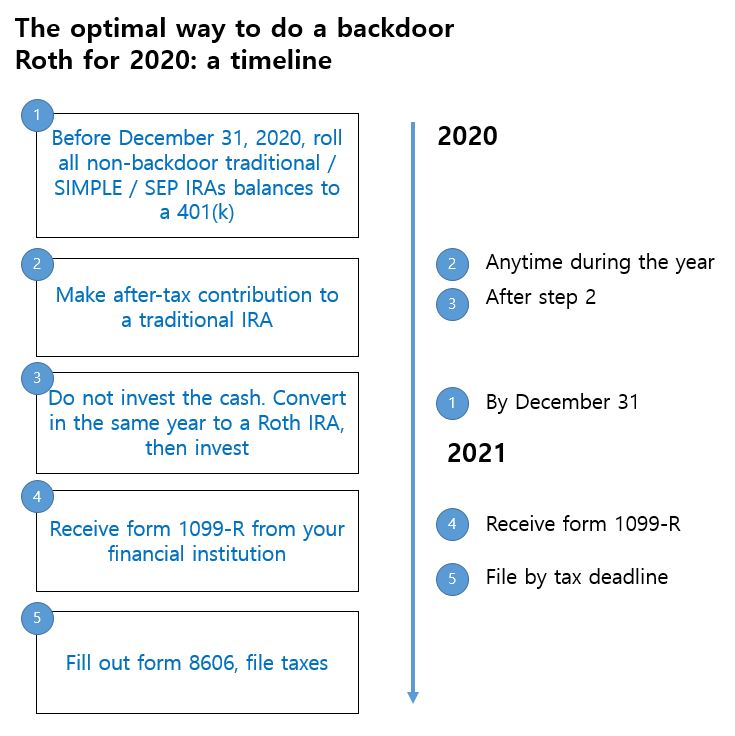

Backdoor roth ira conversion rules. Even if your income exceeds the limits for making contributions to a roth ira you can still do a roth conversion sometimes called a backdoor roth ira you will owe taxes on the money you. You can convert your traditional ira to a roth ira by. Then move the money into a roth ira using a roth conversion. A conversion can get you into a roth ira even if your income is too high the conversion would be part of a 2 step process often referred to as a backdoor strategy.

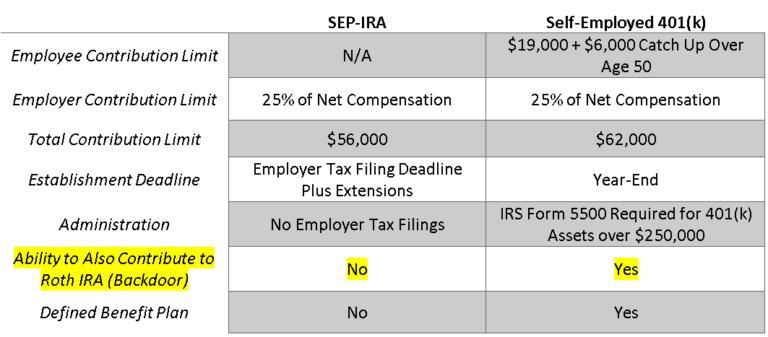

Rather they are usually traditional ira accounts or 401 k s which have been converted to roth iras. Any funds in a qrp that are eligible to be rolled over can be converted to a roth ira. Rollover you receive a distribution from a traditional ira and contribute it to a roth ira within 60 days after the distribution the distribution check is payable to you. Since traditional iras don t have an income limit for contributions and traditional iras can be converted into roth iras individuals can fund a traditional ira with nondeductible contributions.

Since the income limits on roth conversions were removed in 2010 higher income individuals who are not eligible to make a roth ira contribution have been able to make an indirect backdoor roth contribution instead by simply contributing to a non deductible ira which can always be done regardless of income and converting it shortly thereafter. While the most common roth ira conversion is one from a traditional ira you can convert other accounts to a roth ira. If you do hold tax deferred ira dollars you ll be subject to taxes when making your conversion per the pro rata rule. A backdoor roth ira is a legal way to get.

First place your contribution in a traditional ira which has no income limits. Income limits are attached to the ability to contribute to a roth ira each year.